Imperial College London and FluidAI Announce Groundbreaking AI Partnership! Read here 🤝

How Does a Liquidity Aggregator Use AI to Predict Cryptocurrency Prices With 99.5% Accuracy?

FLUID is building a low-latency architecture that will provide Best Execution in the digital assets market. FLUID’s competitive edge is that it uses Artificial Intelligence (AI) quant-based methodologies to provide a high throughput service to its clients, in contrast to other systems that only offer quant-based solutions.

How Does a Liquidity Aggregator Use AI to Predict Cryptocurrency Prices With 99.5% Accuracy?

Summary

- FLUID is building a low-latency architecture that will provide Best Execution in the digital assets market

- By utilizing Machine Learning (ML) and Deep Learning (DL) methodologies, FLUID can accurately estimate the price of an aggregated order book

- FLUID’s patented hybrid cryptocurrency prediction models consist of powerful Deep Learning techniques like Artificial Neural Networks (ANN) and Support Vector Machines (SVM)

FLUID is building a low-latency architecture that will provide Best Execution in the digital assets market. FLUID’s competitive edge is that it uses Artificial Intelligence (AI) quant-based methodologies to provide a high throughput service to its clients, in contrast to other systems that only offer quant-based solutions.

The Role of AI in Crypto

Cryptocurrency markets are complex and nonlinear by nature. It takes time and expertise to comprehend the unpredictable cryptocurrency market and carry out investments. As more tech-driven solutions become available, asset managers are increasingly turning to AI, Machine Learning (ML), and Natural Language Processing (NLP) to make sense of managing crypto assets in fund portfolios. These models provide a multi-feature architecture leveraging multiple indicators such as quantitative models, sentiment analysis, commodities markets, the CPI index, and futures and options markets.

Blockchain technology, the foundation for cryptocurrencies, is being used in conjunction with AI and ML to address many of the problems facing the digital assets market. AI and ML are being utilized in making accurate trade forecasts and reducing some uncertainty associated with crypto investing. Due to recent technical advancements, investors can forecast important market trends and make more informed investment decisions. Currently, researchers have the ability to gather and analyze enormous data sets, providing insightful information on various digital assets.

The combination of blockchain with AI and ML also provides a more potent forecasting tool for the crypto industry. It is common knowledge that blockchain maintains a digital record of all transactions and other valuable information. Blockchain technology makes it possible to store and securely share data, so AI and ML can be used to analyze historical and real-time cryptocurrency data and produce valuable insights. Numerous blockchain transactions can also reveal behavioral trends that can be used to identify market drivers for cryptocurrencies.

FLUID’s Competitive Edge

FLUID uses a hybrid prediction model for cryptocurrencies that combines machine learning and deep learning to accurately forecast real-time order book values. The use of deep learning is one of the significant characteristics that sets apart FLUID’s hybrid cryptocurrency forecasting model.

This may also be seen as scalable machine learning that effectively classifies and locates relationships between datasets to estimate prices. Together with a group of specialists in AI led by Dr. Lawrence Henesey, a professor at the Blekinge Institute of Technology in Karlskrona, Sweden, FLUID has created models that have been positively stress-tested based on live and historical data.

Predicting Crypto Prices With 99.5% Accuracy

Because of their linear nature and inability to understand the different factors of large amounts of data, research has shown that statistical quant models have limited predicted precision. This is where Al comes in. By utilizing machine learning and deep learning methodologies, FLUID can grasp the macroeconomic and microeconomic aspects required to accurately estimate the price of an aggregated order book.

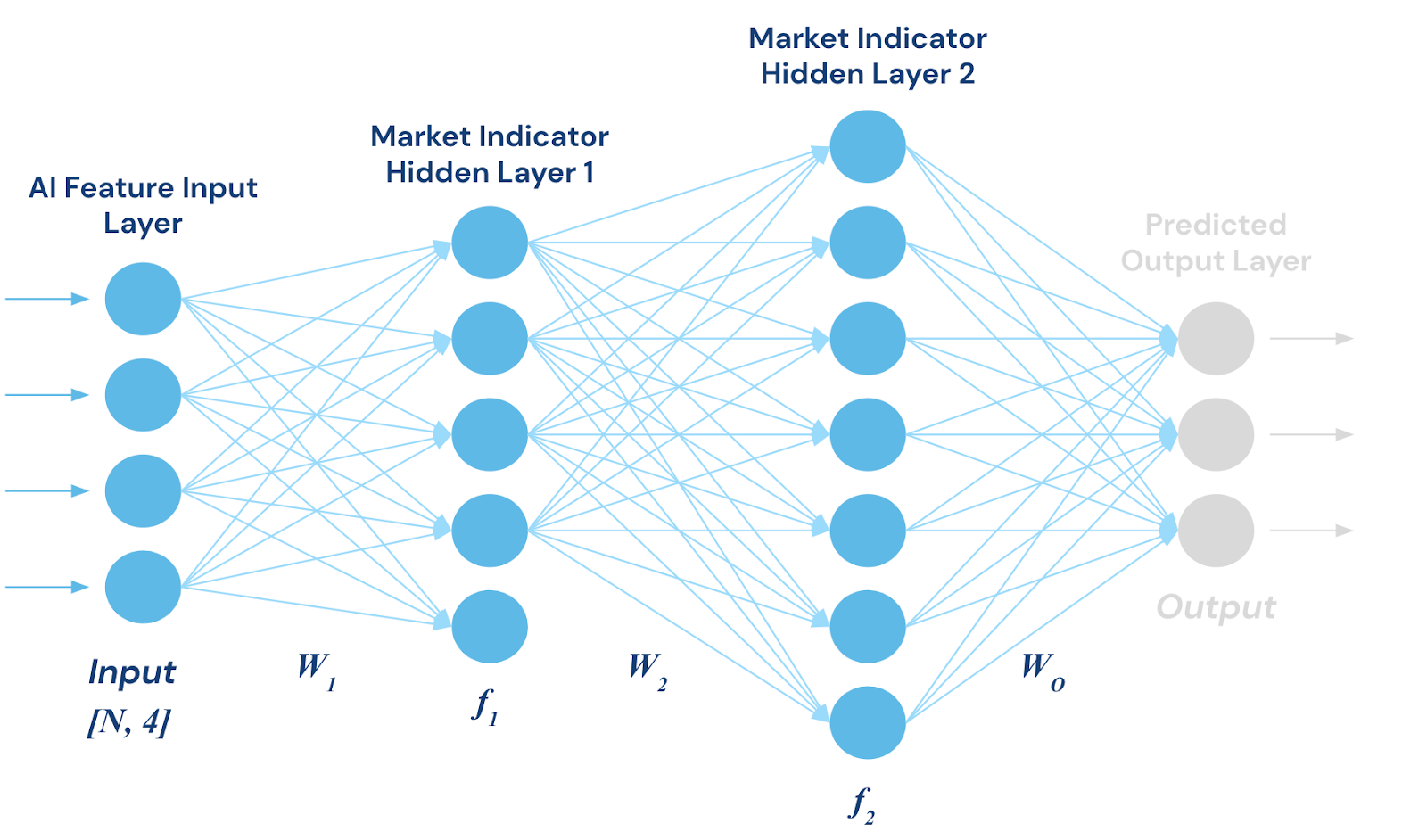

FLUID’s patented hybrid cryptocurrency prediction models consist of powerful Deep Learning techniques like Artificial Neural Networks (ANN) and Support Vector Machines (SVM). FLUID’s prediction model develops data-driven computer programs that can execute complicated tasks like predicting values without explicit instructions, or in other words, autonomously, and is supported by linear and nonlinear statistical models, among other techniques.

Cryptocurrency marketplaces have complex dynamics because of the many interconnected parts and multiple nonlinear features. This complexity, brought on by the high volatility and massive data points, makes it challenging to make predictions using standard methodologies. To improve the forecasting of cryptocurrency order book prices in a time series with its complexity and nonlinear nature, FLUID leverages ML. In addition to being more flexible than traditional methods, it can also reveal hidden structures in data sets by identifying relations and predictions between essential variables.

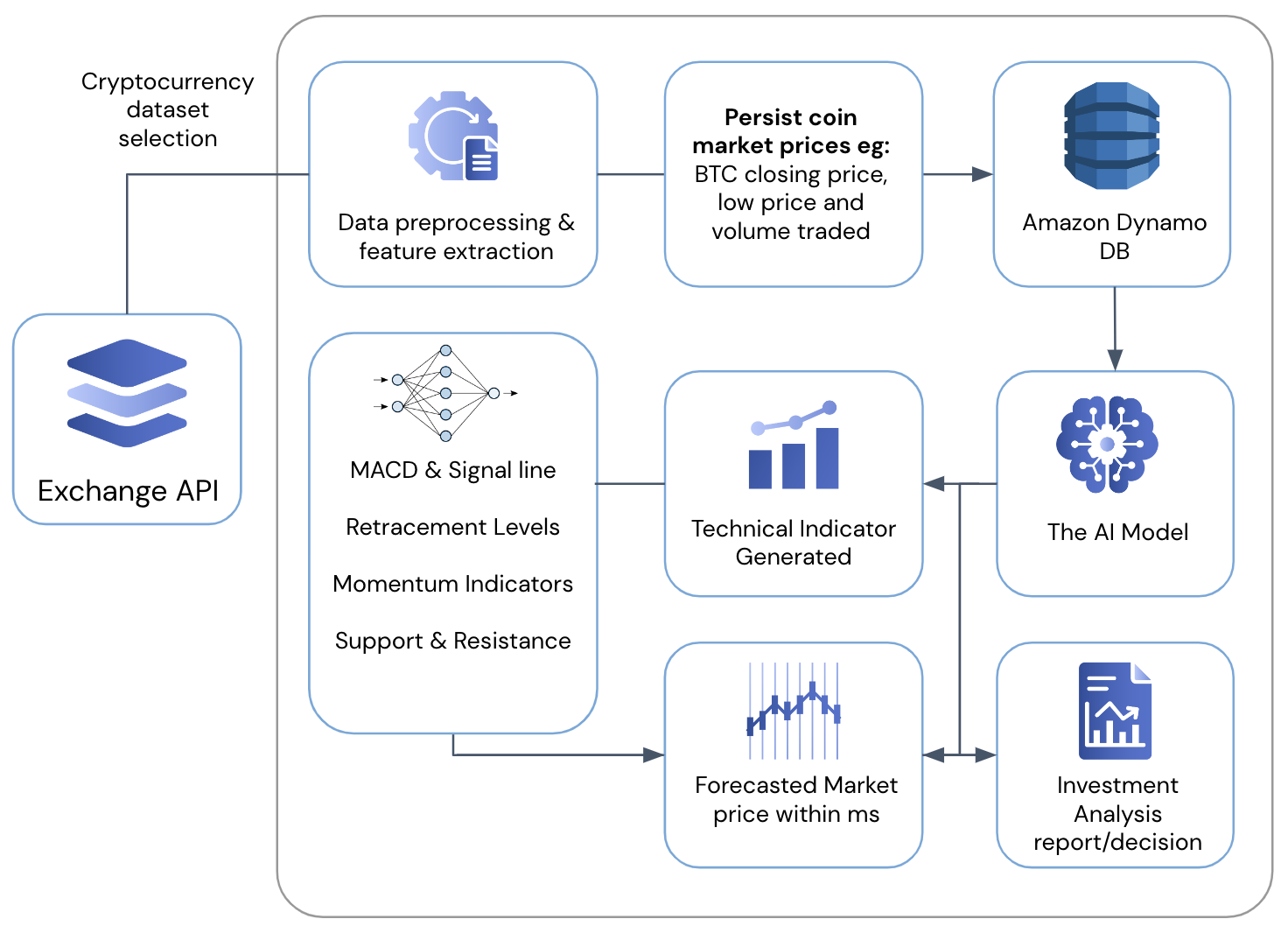

In the figure below, a description of the architecture is presented, which explains the flow and relationships of various activities and modules:

FLUID’s AI: Cryptocurrency Prediction Architecture

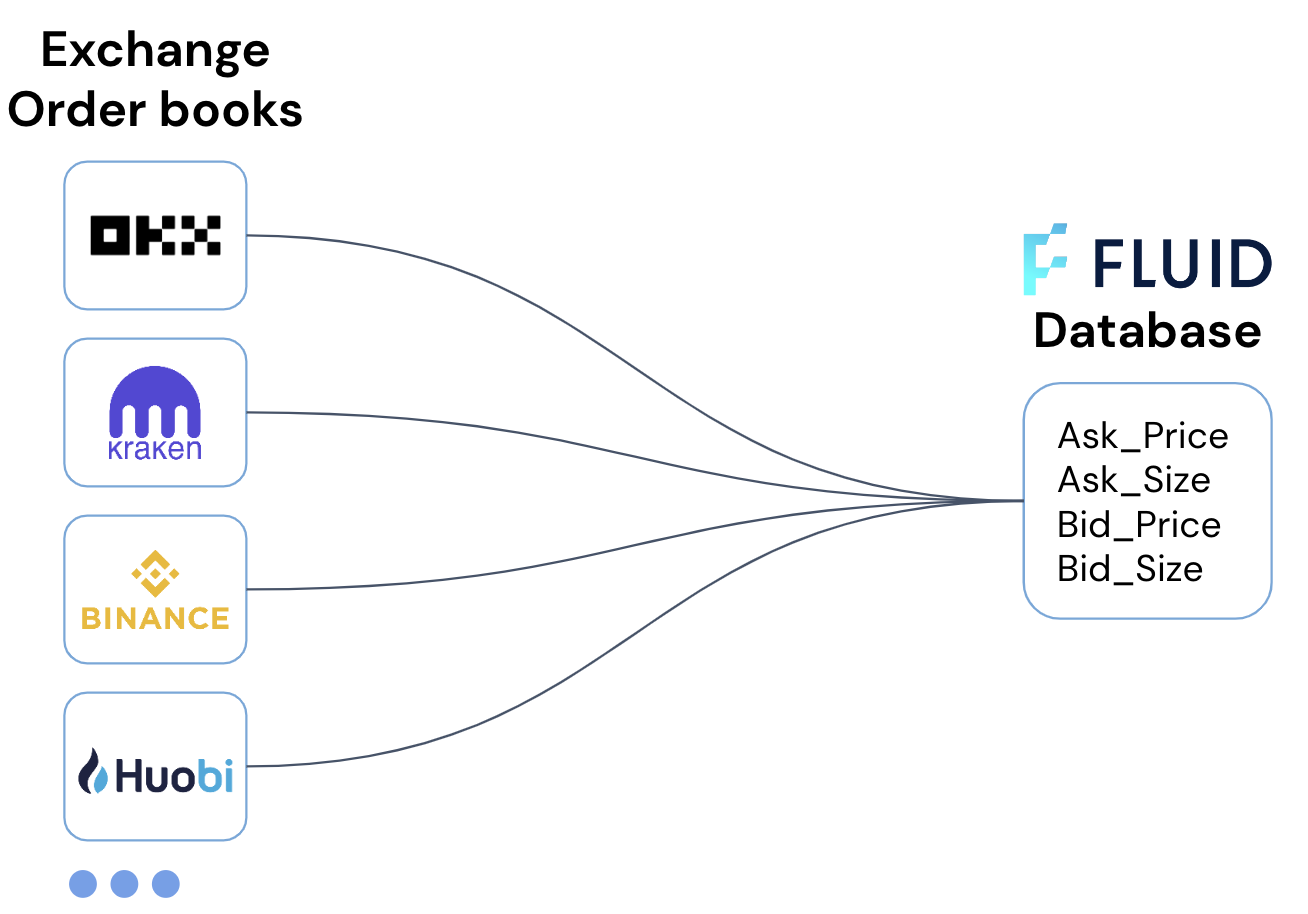

Data is loaded to build FLUID’s model, and information is also extracted from the API dataset as follows:

Example:

The model starts by creating the dataset with features and filters the data into the features list. We then add a prediction column and set of dummy values to prepare the data for scaling and print the tail of the data frame for training:

The FLUID model begins to predict, test, and learn where data variables are routed to various gates. The model then generates a single prediction within ms if the market is going up or down as identified within the hidden layers:

FLUID’s model was benchmarked against actual exchange data to generate a prediction price, and produced the following results:

- 99.50%+ accuracy, between 1 to 8 seconds

- 95%+ accuracy, between 9 to 30 seconds

In summary, based on the datasets employed and the use of Neural Networks, our machine learning-based model can predict prices accurately with a high level of confidence.