Imperial College London and FluidAI Announce Groundbreaking AI Partnership! Read here 🤝

Macro & Crypto Markets Newsletter #5

Macro & Crypto Markets Newsletter | April 2023

Macro & Crypto Markets Newsletter #5

Macro Markets Themes

- The US Banking Crisis Redux

- US Debt Ceiling Deadlock & Market Implications

- The De-Dollarisation Narrative

The US Banking Crisis Redux

- In the wake of the collapse of Silicon Valley Bank and Signature Bank last month comes the fall of First Republic Bank, the third US bank to fail in just six weeks.

- The bank announced a more than 40‰ drop in its total customer deposits in the first quarter, from $176.4 billion (Dec. 31st, 2022) to $104.5 billion (March 31st, 2023). The magnitude of this incident surprised investors, and likely prompted a decline in the firm’s share price. See below:

Source: Tradingview

- The Federal Deposit Insurance Corporation (FDIC), the government entity responsible for providing insurance to depositors in the US commercial banking system, stepped in on May 1 to shore up confidence in the banking system.

- FRB has been acquired bysold to JP Morgan, the world’s fifth largest bank by total assets:

- JP Morgan will take on $92 billion of FRB’s customer deposits, and FRB’s $203 billion in assets.

- The FDIC is forced to cover a loss of $13 billion.

- The sale unfolded over the final weekend of April, and with banking regulation that disallows such a transaction i.e., JP Morgan is technically not allowed to acquire FRB.

- Such actions provide insight into what is at stake. A further loss of confidence in US banks needs to be prevented at all costs, even if it means completely undermining established banking rules.

- The US banking system remains highly fragile, and more developments are likely in the coming months.

US Debt Ceiling Deadlock & Market Implications

- The raising of the US debt ceiling is once again top-of-mind for investors as the eventual issuance of new debt by the US Treasury Department has implications for financial markets in the coming months.

- The issue at hand is that the US Congress needs to agree to raise the cap it places on the US Treasury and the latter’s ability to spend public funds. This limit will ultimately be raised given that the alternative, a default by the US government on its debts, would be a materially worse outcome for all parties involved, including investors.

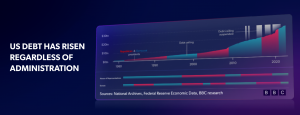

- This means markets will likely not emphasize the risk of default by the US government as this risk has periodically arisen before. See chart below:

Source: Lyn Alden & BBC

- The key risk today is one of liquidity:

- Once the debt ceiling has been resolved, the US Treasury will once again be able to issue new debt so that the government can continue to meet all its spending promises.

- New debt issuance means a removal of liquidity i.e., money in the system which has the potential to find a place in financial markets.

- This will occur at a time when the Federal Reserve will continue its Quantitative Tightening programme which is also a removal of liquidity

- Financial markets, therefore, face a potential double negative of liquidity removal, one from the Treasury and one from the Federal Reserve.

- This is not an immediate risk as it partly depends on how the debt ceiling issue is first resolved, but it does present risk assets like US equities and crypto with material headwinds in the coming months.

The De-Dollarisation Narrative

- 2023 has so far seen a growing chorus of calls to move away from the US dollar’s centrality in the global economy.

- Countries such as Brazil, India, and Russia, amongst others, have begun taking tentative steps to conduct trade in currencies other than the US dollar

- These countries were forced to protect their own currencies and economies against a rapidly strengthening dollar last year, realizing, once again, the negative implications of conducting their trade in a currency which is not their own

- The US dollar remains dominant in global currency reserves. However, its share has decreased to 58% at the end of 2022, down from 70% in 1999, – a steady decline over two decades.

Source: International Monetary Fund

- Talks of an imminent demise of the dollar are severely overblown as changes in world reserve currencies are typically multi-decade processes based on history.

- What makes this topic noteworthy is the increased attention it has received in mainstream media in the past few months. A growing narrative around the decline of the US dollar, is likely a growing tailwind for store-of-value assets such as gold and bitcoin.

Crypto Market Themes

- EU Passes MiCA Regulation

- Ethereum: Shanghai Upgrade is a Non-event

- Bitcoin: Spot-driven Rally?

EU Passes MiCA Regulation

- The European Union Parliament has passed the Markets in Crypto Assets (MiCA) regulatory framework in April

- This framework provides a unified set of regulations for all EU member states, and will take effect in 12 to 18 months.

- Key points include:

- Issuers of most crypto assets are required to publish a white paper detailing the issuer, potential risks, the underlying technology being utilized, token-economics, and environmental impacts of its consensus mechanism

- Crypto firms operating in the EU require a license to offer brokerage services. Possession of this license means companies are complying with minimum standards regarding the safekeeping of assets, information disclosure, and capital reserve requirements

- MiCA exempts decentralized protocols from its purview, provided that the services these protocols offer are done without any intermediaries – further clarity here is expected in the future

Source: Patrick Hansen (Paddi’s Substack)

- MiCA has been welcomed by industry players like Coinbase, Binance, and Bitstamp as it removes regulatory uncertainty and provides a platform for growth for crypto firms across the region

Ethereum: Shanghai Upgrade is a Non-event

- The recent Ethereum upgrade, the Shanghai hard fork, occurred with no disruption.

- The fear of large-scale dumping of ETH once the option to withdraw was enabled never materialized. In fact, the opposite occurred with the ETH price spiking to $2100 before closing the month around the same level prior to the upgrade.

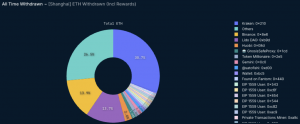

- Entities that have withdrawn their staked ETH have typically done so for regulatory reasons. Kraken, a US exchange, has been forced by regulators to wind down its US staking operations while Binance is partially withdrawing its ETH due to increased US regulatory scrutiny.

- Since the upgrade, approximately 1.96 million ETH has been withdrawn, while 1.56 million ETH has been deposited into new staking contracts, meaning a net withdrawal of 402 100 ETH over the past three weeks, versus a total ETH supply of 120.4 million

- A dashboard for monitoring withdrawals can be found here:

Source: Nansen

Bitcoin: Spot Driven Rally?

Source: Glassnode

- The above chart makes a robust case for why the upside price action in BTC over the past few months has occurred in a healthy manner.

- The orange line is a measure of leverage, the use of debt to speculate on BTC price movements. It has come down notably since early October 2022 and continues to trend lower.

- This reduction of leverage indicates that market participants are choosing to use spot markets instead of futures markets to gain BTC exposure

- Combine this with an increasing number of new BTC addresses and rising transfer volumes, this implies that recent demand for BTC has been less for speculative reasons and more likely for long-term investment.

Notable News Stories

- 2023 State of Crypto Report – a16zcrypto | Link

- FTX has recovered $7.3B and will consider re-starting its crypto exchange| Link

- London Stock Exchange to offer Bitcoin futures and options| Link

- UAE regulator to start accepting license applications from crypto firms| Link

Market Performance

Source: Bloomberg; *Annualised figures; All returns in USD.

Bitcoin Network Metrics

Source: Coinmetrics & The Block

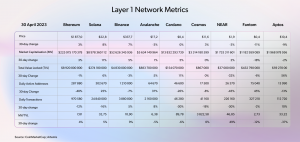

Layer 1 Network Metrics

Source: CoinMarketCap; Artemis

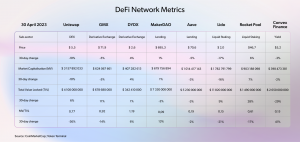

DeFi Network Metrics

Source: CoinMarketCap; Token Terminal

NFT Trading Volumes Per Chain

Source: The Block