Imperial College London and FluidAI Announce Groundbreaking AI Partnership! Read here 🤝

Macro & Crypto Markets Newsletter #1

- Major central banks continue hiking interest rates to curb inflation

- US dollar consolidates following a strong run in 2022

- The latest bear market rally in global equities wanes towards year-end

Macro & Crypto Markets Newsletter #1

Macro Market Outlook

- Major central banks continue hiking interest rates to curb inflation

- US dollar consolidates following a strong run in 2022

- The latest bear market rally in global equities wanes towards year-end

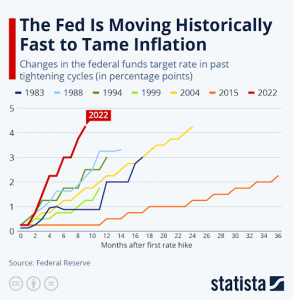

Major central banks (US Federal Reserve, European Central Bank, Bank of England, etc.) once again raised short-term interest rates between 0.25% and 0.50% this month. The aggressive hikes, relative to previous cycles, are clear in the chart below and indicate a level of concern and the action taken to address high inflation. The consumer price increase rate looks to have peaked in most Western nations—starting with the US, followed by tentative signs in the Eurozone and the United Kingdom. Although a positive step, inflation remains at extremes compared to central bank targets and, more importantly, socially acceptable levels. At this point, we are likely closer to the end of this interest rate hike cycle, with much of the impact of higher rates on economic activity likely manifesting in the first half of 2023. Central banks are closely watching incoming economic data for signs of weakness and are likely to adjust future policy decisions accordingly.

Source: Statista

The strength of the US dollar has been a major theme across all markets in 2022. This is understandable, given the turmoil and levels of uncertainty experienced by investors that have used the world reserve currency as a safe harbor. As per the DXY Index, USD strength looks to have peaked in late September and now appears to be consolidating following a decline over the past few months. Looking forward, it is difficult to see a persistent downtrend for the USD as the economic and geopolitical, etc., outlooks remain highly uncertain and investors are likely to continue to seek safety. Further USD strength in 2023 is more likely than not. So why is the US dollar important for crypto markets? It exhibits a strong, negative correlation with Bitcoin and Ether as with other major risk assets such as emerging market equities and commodities. The persistence of USD strength is likely to remain a material headwind for crypto markets in 2023.

Considering the above factors, the bear market in global equities, and chiefly US equities, makes sense. December saw the conclusion of the third bear market rally early in the month. The S&P500 Index reached a local high of 4100 following a low of 3490 in mid-October (see chart below). Equities broadly declined once again this month as investors agreed that the market outlook was far from optimistic. Headwinds such as the rising risk of global and regional recessions, central banks remaining steadfast in their positions to tame consumer inflation, a likely default scenario with the Chinese economy re-opening due to COVID frustrations, and a general investor over-exuberance on China, all remain. This will likely be no different for crypto markets.

Source: Tradingview

Crypto Market Outlook

- Sam Bankman-Fried (SBF) is back in the US out on bail while former partners reach plea deals

- Peak FUD over Binance in wake of FTX collapse

- The liquidity crunch at Genesis Capital remains unresolved

The FTX saga continued this month with SBF being extradited to the US and posting bail of $250 million. He has been criminally charged with eight counts, including securities fraud and money laundering, and is expected to enter a guilty plea next week. Meanwhile, Gary Wang and Caroline Ellison, co-founder of FTX and former CEO of Alameda Research respectively, have pleaded guilty to numerous criminal charges and have been cooperating with authorities. One may interpret these developments as encouraging and even necessary first steps in the wake of the FTX collapse last month but the road to resolution and the recovery of investor funds are likely to take years. The investment bank Jefferies estimates that a recovery rate of between 20 to 40 cents on the dollar may be possible for FTX creditors.

Concerns that Binance – the world’s largest crypto exchange by volume – was the next in line to fail, echoed throughout December. The shock-fall of FTX likely fueled the anger and frustration of crypto enthusiasts that subsequently spilled over to Binance with founder CZ at the forefront to blame.

Binance’s exchange liability on-chain data (client funds) shows no material drawdowns, whereas traditional and social media flooded the opposite stance earlier in the month. While this noise has died down, for now, many questions remain. Is the current proof-of-reserves sufficiently comprehensive? Is there the possibility of a proper audit by highly credible accounting firms? Will CZ be pursued by US authorities for criminal charges in relation to FTX? These unanswered questions and more are likely to remain a dark cloud over crypto markets in the immediate term.

Genesis Capital – a subsidiary of Digital Currency Group (DCG), one of crypto ecosystem’s most systemically important companies and owner of Grayscale Investments – is facing a liquidity crunch after pausing client withdrawals in late November. Genesis reportedly needs a $1 billion capital injection to reopen withdrawals. To date, a clear path to resolution remains unknown, meaning, in addition to the above two variables – FTX and Binance – the Genesis/DCG saga represents further contagion risks for crypto markets. Three possible paths forward include a bankruptcy filing, likely a very lengthy and costly exercise to the detriment of creditors; an out-of-court settlement with creditors taking a haircut on what is owed to them; or a capital infusion by parent company DCG which would allow Genesis clients to withdraw funds in full.

Notable News Stories

- Brazil’s cryptocurrency regulation set to become law at midnight | Link

- PayPal working with crypto wallet MetaMask to offer easy way to buy crypto | Link

- Binance proof-of-reserves auditor Mazars pauses all work for crypto assets | Link

- Former US president Donald Trump unveils NFT trading card collection | Link