Imperial College London and FluidAI Announce Groundbreaking AI Partnership! Read here 🤝

Macro & Crypto Markets Newsletter #3

Macro & Crypto Markets Newsletter #3

Macro & Crypto Markets Newsletter | February 2023

Macro Markets Themes

- Key data points surprise to the upside

- Asian Central Banks expand their balance sheets

- Strong, positive US Equity/Bitcoin correlations unwind

Key data points surprise to the upside

- Economic growth and inflation data remain the dominant variables guiding major financial markets, chiefly US data points as it is the world’s largest economy

- February saw numerous economic measures (US employment, retail sales, consumer sentiment etc.) beat investor consensus expectations, meaning economic growth remained more resilient than broadly expected

- Similarly, headline US inflation for January printed above expectations at 6.4% year-on-year, although the downtrend of slowing inflation remains in place when considering the past seven months

- Considering all of the above, markets have revised its view of the future path of short-term interest rates upwards. More rate hikes by the Federal Reserve are anticipated over the coming months as recession risks have abated in the immediate term. More resilient economic activity, and inflation appears stickier than exxpected one-month ago, higher-than-expected headline CPI print

- Such shifts have likely being the main driver behind recent market moves: weaker US equities, stronger US dollar and rising US government bond yields

- February is a good indication of how data-dependent markets are currently

- Crypto markets have held up relatively well despite the shifting short-term outlook and sentiment amongst investors– see theme 3 below for more on this

Asian Central Banks expand their balance sheets

- As a counterpoint to US, European Union (EU) and United Kingdom (UK) central banks, the People’s Bank of China (PBoC) and the Bank of Japan (BoJ) have run expansionary monetary policy playbooks to support their economic reopening and domestic bond market respectively

- This matters as it means the PBoC and BoJ have added new liquidity to their local financial systems, and serves at least a partial offset to the actions of their western peers who are running contractionary monetary policy i.e., Quantitative Tightening and increasing short-term interest rates

- Liquidity is a highly nuanced topic; in aggregate, new liquidity is broadly supportive of financial markets, however, the magnitude and timeframe of such additions along with the actions of other central banks (in alignment or running counter) matter far more overall

- Therefore, while the actions by the Chinese and Japanese monetary authorities have provided a short-term tailwind to bolster financial markets over January and into February, this positive effect now appears to be waning

- For crypto, the actions of these two Central Banks have likely been highly supportive of the market narrative of a returning Asian investor/speculator

Strong, positive US Equity/Bitcoin correlations unwind

- The correlation between US equities and Bitcoin, a measure of how two assets move together over time, is evolving once again

- Throughout 2022, Bitcoin, and by extension all crypto, has exhibited a strong, positive correlation with the S&P500 and technology-focused NASDAQ index. This implies that global investors have grouped these assets into the same allocation bucket of risk-on assets and that the market forces driving the performance of both were largely the same

- Since late January and throughout February, correlations have moved from strongly positive to mildly negative – see the chart below which shows daily correlation coefficients

- This is notable for its implications since macro forces driving most of the crypto market’s price action last year is no longer as impactful, rather, other more crypto-specific factors are at play

- Monitoring how these correlation relationships evolve is a useful indicator of the shifting forces which drive market price action

Source: Trading View

Blue = S&P500 Index daily correlation coefficient with BTC; Green = NASDAQ Index daily correlation coefficient with BTC

Crypto Market Themes

- US regulators clamp down on crypto

- Shifts in the global regulatory landscape

- How real is the return-of-the-Asian-bid narrative?

US regulators clamp down on crypto

- The Securities and Exchange Commission (SEC) in the US, along with other related regulatory bodies, launched a coordinated effort to regulate crypto by enforcing and imposing fines for infringing US securities laws; this comes in the wake of the FTX collapse last November

- Kraken, a US-based crypto exchange, was fined $30 million to settle charges levied by the SEC that it failed to register its staking-as-a-service offering as a securities product. The exchange has paid the fine and stopped offering staking related services in the country entirely

- Terraform Labs and its founder Do Hyeong Kwon of Terra Luna infamy was charged with securities fraud; allegations include market manipulation by faking transactions and reserves

- Paxos, Binance, and Coinbase are all currently being scrutinized by the financial body

- The latter is being investigated over its staking offering, with Coinbase pushing back, and indicating a willingness to go to court over the matter, arguing its offering is different from that of Kraken

- Paxos, the issuer of BUSD (Binance USD stablecoin) is currently in talks with the SEC after being forced to stop issuing BUSD and to end its relationship with Binance

- Finally, Binance itself is facing scrutiny over it staking product, with the SEC investigation still ongoing

Shifts in the global regulatory landscape

- The Hong Kong Securities and Futures Commission (SFC) has proposed rules for a licensing regime of crypto exchanges, and plans to allow retail investors limited access to these regulated exchanges

- The licensing regime is anticipated to go live from June 1, while the consultation process to allow retail access is ongoing with no defined deadline yet

- These actions are in stark contrast to the path being pursued in the US where much uncertainty remains

- Clear regulation is a key requirement for greater institutional involvement and adoption globally. The time and resources required for participation are far greater than at the retail level

- February marks new developments in the race for talent and businesses within the crypto industry based on regulatory jurisdiction. HK and other Asian centers, like Singapore, are becoming increasingly attractive, while in the opposite appears to be true in the US

How real is the return-of-the-Asia-bid narrative?

- Spend enough time on crypto-related social media and you would have seen the rise of the market narrative that this latest price rally has been driven by the Asian retail investor

- This is a reasonable assertion when you combine the themes of: Asian Central Banks expand their balance sheets; Strong, positive US Equity/BTC correlations unwind; and Shifts in the global regulatory landscape

- However, when considering market data, this idea appears to be premature

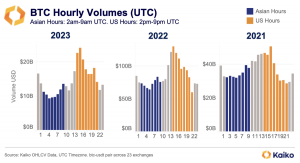

- The chart below compares BTC daily trading volumes in 2023, year-to-date, with two years prior

- What it shows is that most of the daily volume continues to occur during US trading hours, implying that BTC price action continues to be driven by the West currently and not by Asia as the narrative suggests

Source: Kaiko

Notable News Stories

- Real world assets and the road to tokenization | Link

- Siemens issues €60m digital bond on public blockchain | Link

- Rihanna NFTs enable holders to earn when this song plays | Link

Market Performance

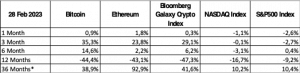

Source: Bloomberg

*Annualized figures; All returns in USD

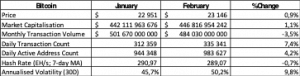

Bitcoin Network Metrics

Source: Coinmetrics & The Block

Layer 1 Network Metrics

Source: CoinMarketCap; Artemis

DeFi Network Metrics

Source: CoinMarketCap; Token Terminal

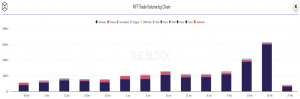

NFT Trading Volumes Per Chain

Source: The Block