Imperial College London and FluidAI Announce Groundbreaking AI Partnership! Read here 🤝

Tackling Significant Industry Barriers to Institutional Adoption

Virtual assets are known for their volatility. Even though the virtual asset market is considered volatile, with the recent digital assets trading and investments boom, many institutional investors seek greater involvement.

Tackling Significant Industry Barriers to Institutional Adoption

Institutional adoption is the new frontier for digital asset projects. Not too long ago, the crypto market value was at $500bn, and only a handful dared to learn and invest how this community operated. But recently, we saw the crypto market value hit an all-time high of $2tr as institutional adoption became a reality and technology pioneers such as Elon Musk and others publicly announced their support of digital assets.

There is no doubt that the crypto market is a volatile space. As a result, many investors have compared digital assets to traditional financial markets like stocks and bonds, specifically to the dot com boom, which shows similar behavioural patterns with a much more significant upside.

By comparing traditional financial markets to digital assets, users can see value creation and how different these markets perform.

Stocks fluctuate in value according to a company’s performance and changes in glocal sentiment. A company’s stock value is also influenced by how many people own shares in a said company. Digital assets do not have a tangible form but work similarly . The ideology is a libertarian-like utopia that has turned into a global democracy as regulators profusely try to control – because it’s now out of control – by trying to centralize and peg virtual assets to tangible values that can be warranted and accountability tracked. And it should, to an extent – that extent being people are protected from fraudulent losses.

Many factors determine how much a stock costs at any time: its current price, its previous prices, whether it has experienced any significant gains or losses, etc. In contrast, digital assets have no such limitations.

A digital asset’s value solely depends on demand and supply on the open market and project potential. However, today’s economic landscape is diverse, with traditional stocks, digital assets, and blockchain-based tokens of various shapes and forms existing side by side.

Traditional Financial Markets Massively Outsize Digital Assets Markets

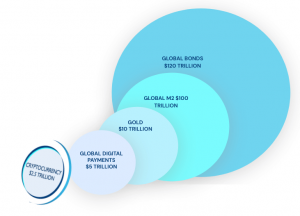

According to information from CoinGecko, the value of the digital assets market just topped $3 trillion for the first time. While impressive, this value pales compared to the value of traditional markets.

For context, the current market cap of the S&P 500, which lists companies including Apple and Amazon, stands at approximately $40 trillion – not including the value of additional market options like bonds, precious metals, and fixed deposits. Despite remarkable progress, digital asset markets have tremendous room for further growth. In contrast to the global market potential for digital assets, the potential stands that crypto is currently estimated to be 1% of the total addressable market (TAM):

Virtual assets are known for their volatility. However, with the recent digital assets trading and investments boom, many institutional investors seek greater involvement.

As the industry grows, so does the need for a stable and fast infrastructure. In addition, institutions are looking to adopt blockchain technology, but digital asset exchanges offer a sub-par experience all too often.

Most digital assets don’t have a stable infrastructure to ensure further development. As a result, there are a lot of risks associated with blockchain technology because it is not yet able to handle the traffic and load requirements well enough to provide services for many users simultaneously. Without a stable infrastructure, the adoption of digital assets will remain limited.

Decentralized technologies need faster adoption if they have any chance of becoming the future of finance. The infrastructure needs to be stable and fast for the digital asset industry to grow. Currently, it can take hours for digital assets to transfer between exchanges, making adoption slow and inconvenient.

Main Institutional Adoption Barriers for Digital Asset Markets

Regulatory Classification

The lack of regulation and proper government support is leading to problems. It’s causing confusion among consumers, which leads to fraud and financial loss.

Regulators struggle to keep up with how the world is moving away from traditional finance and transitioning into a new digital economy. From the simplest way Bitcoin works to how much energy each cryptocurrency uses, they’re constantly trying to catch up on all the compounding information for proper regulation.

FLUID understands the challenges that compliance exchanges and virtual asset regulatory frameworks will bring to the industry. With this knowledge, FLUID can help member exchanges adapt to these challenges through KYT and AML standards and “travel rule” compliance. In addition, this allows for efficient access of data, when needed, for all exchange partners.

Security of Asset Custody

Asset custody is a kind of fundamental matter to be considered in cryptocurrency. It helps to ensure the assets under management by an investment firm will be safe and secure for any investor. Investors need to know their funds will be available when needed, not just sitting idle in an account somewhere.

Market Manipulation

Market manipulation is the act of artificially influencing the price of an asset through various deceptive means. Unfortunately, a lot of crypto investments develop via market manipulation.

For example, you may see an IDO promising high returns on investment but doesn’t have an actual product or service to offer. This manipulation could occur because of nefarious activity such as wash trading or creating fake accounts to inflate the token’s value before launching their token for sale. As a result, it’s difficult for any investor to tell if they’re dealing with a legitimate project or a scam.

FLUID Provides a Comprehensive One-size-fits-all Solution

Present day asset markets suffer from a lack of liquidity, pricing discovery, and execution problems. The market is described as fragile with thin volumes across trading pairs. FLUID combines resources across member exchanges to create an order book to connect institutions and retail investors.

With FLUID’s innovative technology, multitudinous transactions are settled instantly and simultaneously across all chains, exchanges, and trading pairs using a blockchain-based solution overlaying an MPC wallet architecture.